💡 Key Takeaways: LLC Formation

- LLC Formation provides liability protection, separating personal assets from business debts.

- Understanding state-specific requirements is crucial for successful LLC Formation.

- Choosing the right registered agent is a key decision.

- Several online services simplify the LLC Formation process.

- Ignoring key legal and tax considerations during LLC Formation can lead to significant problems later.

LLC Formation represents a crucial step for entrepreneurs seeking to establish a legally sound and protected business entity. As we move into 2026, the landscape of business formation continues to evolve, with new technologies and legal precedents shaping the process.

300×250

Detailed Overview & Historical Context

The concept of the Limited Liability Company (LLC) emerged in the late 20th century as a hybrid business structure blending the pass-through taxation of a partnership with the limited liability of a corporation. Wyoming was the first state to adopt LLC legislation in 1977, though it took several years for the IRS to clarify the tax treatment of LLCs, leading to wider adoption in the 1990s.

Since then, LLC Formation has become incredibly popular, especially among small business owners. The flexibility and simplicity of LLCs make them an attractive option for various industries. Today, every state offers LLC formation, although the specific requirements and regulations vary. This variability is a critical factor to consider when planning your LLC Formation.

The legal landscape surrounding LLC Formation is continuously being shaped by court decisions and legislative updates. Staying informed about these changes is vital, particularly regarding issues like member liability, operating agreements, and dissolution procedures. For instance, some states are increasingly scrutinizing the “piercing the corporate veil” doctrine in LLC contexts, which could expose members to personal liability in certain situations.

Moreover, the digital age has significantly impacted LLC Formation. Online services and platforms have streamlined the process, making it more accessible to entrepreneurs than ever before. However, this convenience comes with its own set of challenges, including the need to navigate a complex web of information and to ensure compliance with all applicable regulations.

Comprehensive Benefits & Advantages

- Limited Liability: One of the primary advantages of LLC Formation is the protection it provides to members’ personal assets from business debts and lawsuits.

- Pass-Through Taxation: LLCs typically enjoy pass-through taxation, meaning that the business’s profits and losses are passed through to the members’ individual tax returns, avoiding double taxation.

- Flexibility: LLCs offer considerable flexibility in terms of management structure and operating procedures.

- Credibility: Operating as an LLC can enhance a business’s credibility in the eyes of customers, suppliers, and lenders.

- Simplified Administration: Compared to corporations, LLCs generally have fewer administrative requirements, such as annual meetings and detailed record-keeping.

- Easy to Raise Capital: While not as easy as raising capital as a corporation, LLCs can still obtain funding through loans and investments from members.

LLC Formation Pros & Cons

| Pros | Cons |

|---|---|

| Liability protection | Complexity in multi-state operations |

| Pass-through taxation | Self-employment tax |

| Flexible management structure | Limited lifespan (in some states) |

| Credibility and professionalism | Variations in state laws |

| Simplified administration compared to corporations | Potential for member disputes |

Comparative Analysis

Several online providers offer services to simplify the LLC Formation process. Here’s a comparison of some leading US-based providers:

| Logo | Provider Name | Best For | Key Features | Pricing | Rating |

|---|---|---|---|---|---|

| LegalZoom | Well-known brand, comprehensive services | LLC formation, registered agent, legal advice | From $79 + state fees | 4.0/5 | |

| Northwest Registered Agent | Excellent customer service, privacy focused | LLC formation, registered agent, privacy protection | $39 + state fees | 4.7/5 | |

| Incfile | Free LLC formation (plus state fees) | LLC formation, registered agent, compliance alerts | $0 + state fees (for basic package) | 4.5/5 | |

| ZenBusiness | Affordable pricing, user-friendly platform | LLC formation, registered agent, worry-free compliance | From $49 + state fees | 4.6/5 |

336×280 / Responsive

Professional Solutions & Enterprise Tools

Successfully navigating LLC Formation often requires leveraging professional solutions and enterprise tools. These tools can significantly streamline the process and ensure compliance with all legal and regulatory requirements.

Professional Solutions

- Registered Agent Service: Every LLC needs a registered agent. Companies like Northwest Registered Agent and LegalZoom provide this service, handling official mail and legal notices.

- Business License Florida: Obtaining the correct business licenses is crucial for legal operation. Florida, like other states, has specific requirements depending on the industry and location.

- EIN Number Application: An Employer Identification Number (EIN) is required for LLCs with employees or those that operate as a corporation for tax purposes. The IRS provides a free online application.

- S Corp Election Form: LLCs can elect to be taxed as an S corporation for potential tax savings. This requires filing Form 2553 with the IRS.

- Business Insurance Quote: Protecting your business with adequate insurance is essential. Obtain a business insurance quote from providers like GEICO or Progressive to safeguard against potential liabilities.

Enterprise Tools

For managing the ongoing operations of your LLC, consider these enterprise tools:

- Customer Relationship Management (CRM): Tools like Salesforce and HubSpot can help manage customer interactions and streamline sales processes.

- Accounting Software: QuickBooks and Xero are popular choices for managing finances and tracking expenses.

- Project Management Software: Asana and Monday.com can help organize tasks, manage projects, and improve team collaboration.

Step-by-Step Implementation Guide

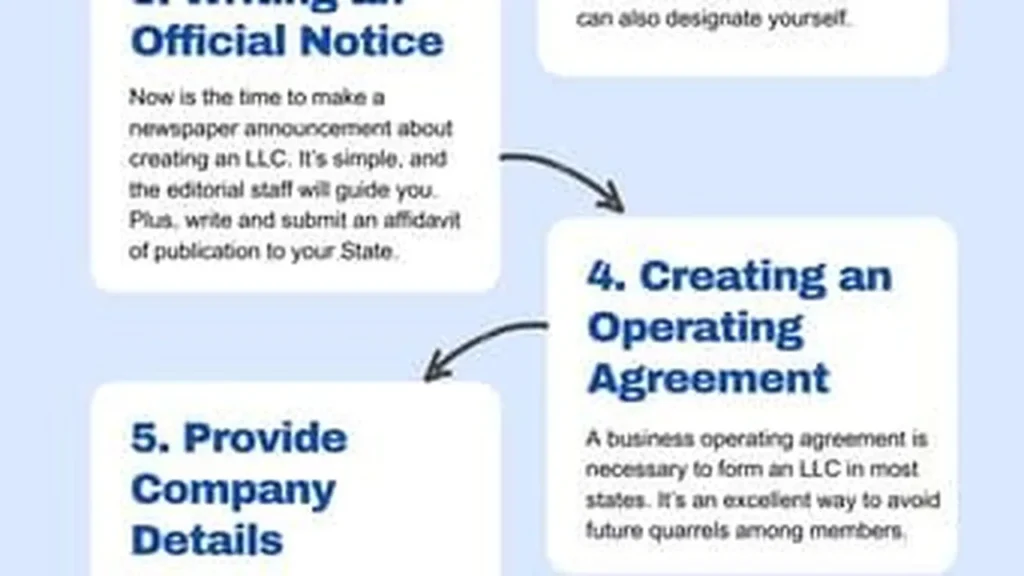

- Choose a Business Name: Select a unique name that complies with state naming requirements. Check for availability and trademark conflicts.

- Appoint a Registered Agent: Designate a registered agent who will receive official legal and tax documents.

- File Articles of Organization: File the Articles of Organization (or Certificate of Formation) with the appropriate state agency. This document formally establishes the LLC.

- Create an Operating Agreement: Although not required in all states, an operating agreement outlines the ownership structure, member responsibilities, and operating procedures of the LLC.

- Obtain an EIN (if needed): Apply for an EIN from the IRS if the LLC will have employees or operate as a corporation for tax purposes.

- Comply with State and Local Requirements: Obtain any necessary licenses and permits and comply with all applicable state and local regulations.

- Open a Business Bank Account: Keep business and personal finances separate by opening a dedicated business bank account.

Expert Insights & Future Trends

Experts predict that the trend towards online LLC Formation will continue, with increasing integration of AI-powered tools to assist with legal compliance and document preparation. Furthermore, there’s a growing emphasis on cybersecurity and data privacy, prompting states to enhance regulations related to data protection for LLCs. As reported by Forbes Advisor, the number of small businesses continues to rise, further driving the demand for simplified and accessible LLC Formation services.

Another trend to watch is the increasing focus on sustainable and socially responsible business practices. LLCs that prioritize environmental, social, and governance (ESG) factors are likely to gain a competitive advantage in the market. This shift may lead to the development of new legal structures and regulations that support sustainable business models.

Real-World Case Studies

Case Study 1: The Startup Tech Company

A tech startup in California used online LLC Formation services to quickly establish their business. By choosing a registered agent service and creating a comprehensive operating agreement, they were able to focus on product development and marketing. Within two years, the company secured significant venture capital funding and expanded its operations nationwide.

Case Study 2: The Freelance Consultant

A freelance marketing consultant in New York formed an LLC to protect her personal assets from potential liabilities. By obtaining the necessary business licenses and insurance, she was able to operate with confidence and attract larger clients. The LLC Formation also provided her with tax advantages and enhanced her professional credibility.

Frequently Asked Questions (FAQ)

- What is the difference between an LLC and a corporation?

LLCs offer liability protection and pass-through taxation, while corporations have a more complex structure and are subject to double taxation (unless they elect S corp status). - How much does it cost to form an LLC?

The cost of LLC Formation varies by state but typically ranges from $50 to $500 in state filing fees, plus any fees for registered agent services or professional assistance. - Do I need an operating agreement?

While not required in all states, an operating agreement is highly recommended as it outlines the ownership structure, member responsibilities, and operating procedures of the LLC. - Can I be my own registered agent?

Yes, you can be your own registered agent as long as you meet the state’s requirements, such as having a physical address in the state and being available during business hours to receive official documents. - What are the ongoing compliance requirements for an LLC?

Ongoing compliance requirements typically include filing annual reports, paying franchise taxes (in some states), and maintaining accurate records.

Conclusion

LLC Formation remains a cornerstone for entrepreneurs seeking to protect their personal assets while enjoying the flexibility of a pass-through taxation structure. By understanding the nuances of LLC Formation, including state-specific requirements, potential pitfalls, and available professional solutions, entrepreneurs can set their businesses up for success in the ever-evolving business landscape of 2026 and beyond. Whether you’re a startup founder or a seasoned business owner, careful planning and execution of your LLC Formation strategy are paramount.